The Guidelines on Private Retirement Schemes Guidelines are issued by the SC pursuant to section 377 of the Capital Markets and Services Act 2007 CMSA. Principal Retirement Services.

Aia Malaysia With Retirement Planning Far Down The List Of Priorities Among Youths Majority Of Malaysians Do Not Have Enough Money In Their Epf Accounts This Is When Private Retirement Schemes

Permanent departure from Malaysia.

. By Friday 25 November 2016 Published in Retirement Planning. Public Bank also distributes a wide range of PRS funds that you may choose to contribute based on your. Private Retirement Scheme PRS is a voluntary scheme that lets you take the lead on boosting your total retirement savings.

Private Retirement Schemes PRS is a voluntary long-term savings and investment scheme designed to help you save more for your retirement. Private Retirement Schemes PRS is a voluntary long-term savings and investment scheme designed to help you save more for your retirement. PRS seek to enhance choices available for all Malaysians whether employed or self-employed to supplement their retirement savings under a well-structured and regulated environment Features Benefits.

Provides yearly individual tax relief of up to RM3000 for investors until 2025. Is part of the AIA Group the largest independent publicly. Residents of Malaysia can buy private insurance.

You can make pre-retirement withdrawal for the following purposes without 8 tax penalty4. To incentivise participation in Private Retirement Schemes individuals are granted tax relief of up to RM3000 and employers are provided tax deduction on contributions to Private Retirement Schemes made on behalf of their employees above the statutory rate and up to 19 of employees remuneration. 3 Copy and paste the data into an Excel sheet.

Fast facts about the Private Retirement Scheme PRS A voluntary scheme for all individuals who are 18 years old and above A way to boost your total retirement savingsregardless of whether you are an EPF member Complements your EPF savings Enjoy PRS personal tax relief of RM3000 per year. You decide how much and when to contribute. Therefore if you are only earning retirement income from a pension or Social Security you will.

Click here to read the full Terms Conditions. The requirements on matters relevant to members are binding on. 2 Select Core Conservative under Malaysia PRS Categories dropdown menu and click the Search button.

PRS seek to enhance choices available for all Malaysians whether employed or self-employed to supplement their retirement savings under a well-structured and regulated environment. What you can read next. Whats a Private Retirement Scheme or PRS How does PRS Malaysia work Basically its a long-term investment scheme with the aim to help you save enough for retirement.

The PRS is a defined contribution pension scheme which allows people to voluntarily contribute into an investment vehicle for the purposes of building up their retirement fund. Aims to provide both employees and self-employed individuals with an additional avenue to save for their retirement. APAM is the provider for AIA Private Retirement Scheme PRS which is an approved pension scheme governed by the SC.

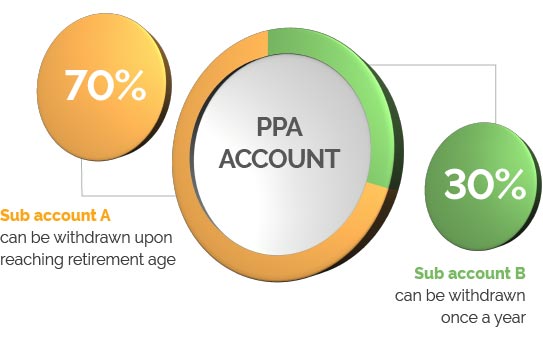

Housing purposes From sub-account B Healthcare purposes From sub-account B Permanent Total Disablement PTD Serious Disease SD Mental Disability MD From both sub-account A and B 2The age group may. Private Retirement Schemes PRS is a voluntary long-term savings and investment scheme designed to help you save more for your retirement. PRS is a scheme approved by the SC.

Differences between Private Retirement Scheme PRS and Deferred Annuity. In contrast to Employees Provident Fund EPF contributing to PRS is voluntary. These Guidelines set out requirements that must be complied with by a PRS Provider and a Scheme Trustee in relation to private retirement schemes.

5 Calculate the 5-Year Annualised Average Return using the geometric average formula. 4657 total views 8 views today. The contents contained shall not be disseminated reproduced or used either in part or in.

4 Choose Performance and extract the YTD return into the Excel sheet. The retirement scheme is fully funded and provides. Private Retirement Scheme PRS is a voluntary long-term contribution scheme designed to help individuals accumulate savings for retirement.

The private hospitals are subsidized by the government so those who can afford it typically opt for private care. A deductible is typically less than 70 and costs an average of 100 per month. PRS is similar to the Employees Provident Fund EPF in that it is a retirement scheme.

Alternatively you can call our Customer Care Centre at 603 7723 7260 or you can leave your detail here. The Employee Provident Fund EPF the national compulsory saving scheme for individuals employed in the Malaysian private sector is based on the Employees Provident Fund Act 1991. However I also realised that there are still quite a handful of people who dont make use of this today.

The PRS complements the EPF offering individuals the ability to build another fund that they can tap into when they retire rather than relying on EPF alone. Terms and conditions apply. Were finding many consumers need help with ensuring they have saved enough to have the retirement lifestyle they dreamed of and these funds are a perfect complement to your Employees Provident Fund EPF member savings.

Private Retirement Schemes PRS in Malaysia October 3 2021 Launched almost 10 years ago back in 2012 Private Retirement Schemes PRS in short has become another tool for Malaysians to save towards their retirement. AIA Pension and Asset Management Sdn. A voluntary investment scheme initiated by the overnment to help Malaysians accumulate savings for a sustainable retirement income.

PRS seek to enhance choices available for all Malaysians whether employed or self-employed to supplement their retirement savings under a well-structured and regulated environment. Differences between Private Retirement Scheme PRS and Deferred Annuity. Only upon reaching the retirement age of 55 years or in the case of death or emigration can withdrawals be made from the PRS account.

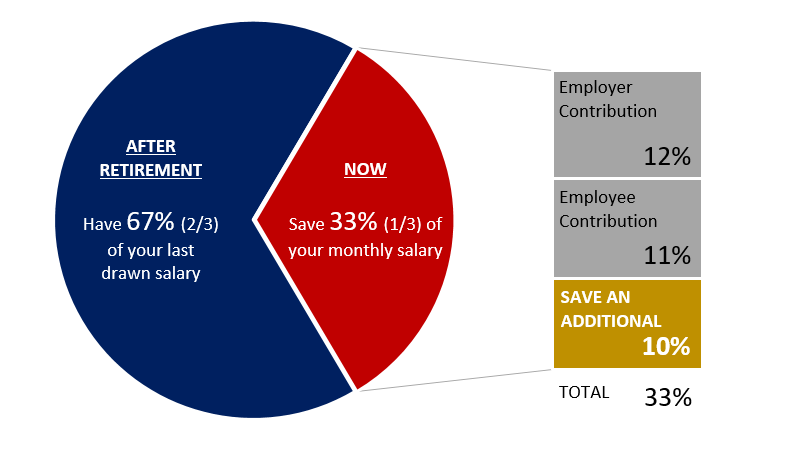

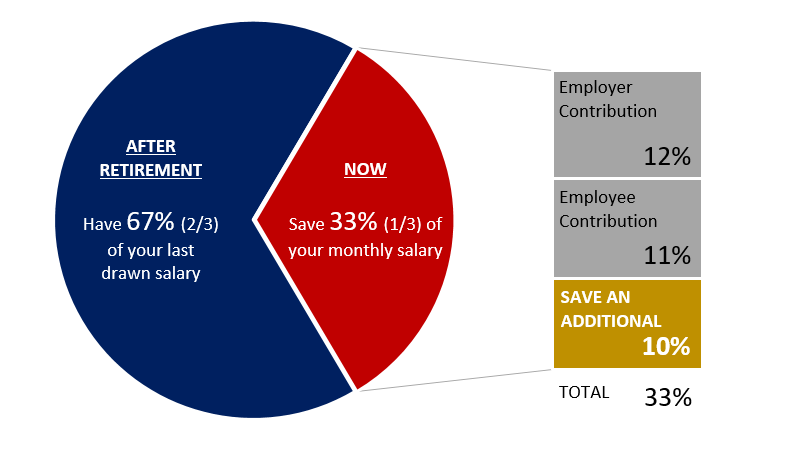

The contents in this website were prepared in good faith and the Private Pension Administrator Malaysia PPA expressly disclaims and accepts no liability whatsoever as to the accuracy relevance completeness or correctness of the information and opinion. Sub-Account A and Sub-Account B. Like with EPF PRS contributions are also divided 7030 into two sub-accounts.

412 PRS aims to increase the options available to all Malaysians whether salaried or self-employed to supplement their retirement savings in an environment that is structured and regulated. We are a wholly owned subsidiary of AIA Bhd a leading insurer that has been serving Malaysia for over 70 years.

Prs Exceeds Rm5 Billion In Total Net Asset Value Businesstoday

Ppa S Fees And Charges Private Pension Administrator Malaysia Ppa

How To Choose The Best Private Retirement Scheme Malaysia

Prs Faq Private Pension Administrator Malaysia Ppa

Explained Private Retirement Scheme The Ikhwan Hafiz

A Guide To The Private Retirement Scheme Prs

Prs For Self Employed Private Pension Administrator Malaysia Ppa

Investors Drawn To Local Private Retirement Schemes Only Because Of Tax Rebates

A Complete Guide To Prs Malaysia Private Retirement Scheme Youtube

Prs Malaysia 2019 Review Should You Really Invest

Li Chun 2022 What Time To Deposit Your Money In The Year Of The Water Tiger

Finance Malaysia Blogspot How Private Retirement Scheme Prs Works Actually

Private Retirement Scheme In Malaysia Dividend Magic

Best Private Retirement Schemes Malaysia 2022 Imoney My

3 Reasons Why You Should Invest In Prs Private Retirement Scheme Malaysia Retirement Youtube

Prs Sets Record Breaking 2018 With Growth In New Members Prs Live

Prs Overview Private Pension Administrator Malaysia Ppa

Prs Sets Record Breaking 2018 With Growth In New Members Prs Live